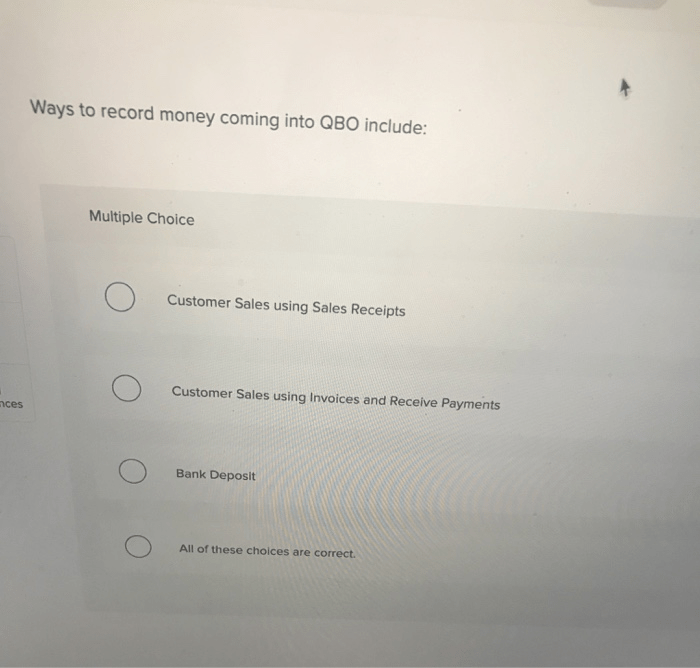

Ways to record money out using qbo include – This comprehensive guide delves into the multifaceted world of recording money out transactions using QuickBooks Online (QBO), providing an in-depth exploration of methods, best practices, reporting capabilities, and advanced features. By equipping readers with a thorough understanding of QBO’s money out management functionality, this guide empowers them to streamline processes, enhance accuracy, and optimize financial operations.

Methods of Recording Money Out Using QuickBooks Online (QBO)

QuickBooks Online (QBO) offers several methods for recording money out transactions, each with its own advantages and disadvantages. Understanding these methods is crucial for accurate and efficient financial management.

Creating Bills

Bills are used to record expenses that have not yet been paid. They allow businesses to track outstanding obligations and schedule payments accordingly. QBO enables the creation of bills with detailed information, such as vendor, invoice number, and due date.

Writing Checks, Ways to record money out using qbo include

Checks are traditional payment methods used to pay bills and other expenses. QBO allows users to create and print checks directly from the platform, simplifying the payment process. Checks provide a physical record of transactions and can be used to reconcile bank statements.

Issuing Credit Memos

Credit memos are issued to customers to correct errors or provide refunds. They reduce the amount owed by the customer and can be applied to future invoices or processed as a direct payment. QBO allows businesses to easily create and issue credit memos, ensuring accurate accounting and customer satisfaction.

FAQ Corner: Ways To Record Money Out Using Qbo Include

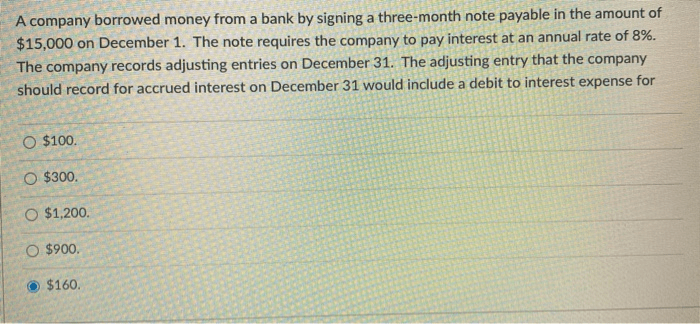

What are the different methods for recording money out transactions in QBO?

QBO offers various methods for recording money out transactions, including creating bills, writing checks, issuing credit memos, and using the “Spend Money” feature.

How can I ensure the accuracy of my money out transactions in QBO?

To ensure accuracy, use clear and concise descriptions, attach supporting documentation, reconcile transactions regularly, and leverage QBO’s validation rules.

What types of reports can I generate in QBO to analyze money out transactions?

QBO provides a range of reports, such as the Profit and Loss Statement, Balance Sheet, and Cash Flow Statement, which can be customized to filter by date range, vendor, or category.